Inflation, Interest Rates, and Ukraine, how am I impacted? April Newsletter

Firm update: I continue to process moving under my own marketing name of Hobbs Wealth Advisors. As I’ve mentioned before, this is simply a name change from Cedar Wealth Partners (which I was a founding partner). I’ll still be using the same processes used with Cedar Wealth Partners and there is nothing clients will need to do.

Watch Newsletter for additional comments, text version is below:

Index Update (As of 03/31/2022 from Yahoo Finance)

S&P 500 (Large Cap): -4.62% YTD | +9.17% 20 Year Return

Russell 2000 (Mid, Small Cap): -7.53% YTD | +8.71% 20 Year Return

Global Market – ex US: -5.49% YTD | +7.19% 20 Year Return

How are portfolios impacted by Inflation and Russia/Ukraine? This has been the most common question I received in March. It seems every day there’s a new headline regarding the war in Ukraine and the 40-year high inflation. It’s interesting too, seeing that I just completed an internal review of the portfolio positioning. As an aside, there are no portfolio changes this quarter. The review process consists of 47 data points against 3 other portfolios managed by household name firms. Just contact me if you’d like to do a deep-dive.

I’m not sure about you, but it feels like it’s just one thing after another these past two years. In March 2020 we had the Covid recession only to have about two years of Covid related restrictions, mixed with an incredibly partisan Presidential election, then 40-year high inflation, and now combined with the war in Ukraine. It’s been a lot over a short period of time!

However, let me remind you that on Feb 19, 2020, the market peak before Covid-19, the S&P 500 was trading at 3,386 and as of this writing (4/1/22) the S&P 500 is now trading at 4,545, roughly a 39% return. I’ll never hold myself as a market predictor, however, I am a fan of using history as a guide. Below, I’ll highlight three points in history.

In 1987, the financial markets experienced the greatest one-day crash, about -22% loss in a single day. The S&P 500 was trading at 283 the day before. Since then, the S&P return with dividends reinvested is about 10.3%.

In 2001, we experienced the terrible events of September 11th. The S&P was trading at 1,093 the day before. Since then, the S&P return with dividends reinvested is about 8.7%.

In 2008-2009, the financial recession wreaked havoc on the global economy. The S&P 500 was trading at 1,252 the day before the Lehman Brothers bankruptcy. Since then, the S&P return with dividends reinvested is about 11.8%.

My point… we’ll never know the future, only God does.

graph showing declines during each year in the SP 500 and ending growth

Our current environment is the same as it’s always been, unknown outcomes. Today the unknown outcomes revolve around Inflation and the atrocities that’s occurring with the war in Ukraine. Next year I’m sure it will be something different. In our inter-connected Global economy, it’s always going to be something, but let me summarize with two questions.

Do you think the world is going to end because of what’s happening with Inflation and in Ukraine? If you answer “Yes” please contact me immediately as I’ll want to transfer your money to you immediately. If you answer “No” – stay the course with a globally diversified, strategic portfolio, like the ones we manage.

When you think about the next 5, 10, 20 years, do you believe the Global Economy is going to continue its forward march? If you answer “No” please contact me immediately as we need to develop a significant plan change. If you answer “Yes” – stay the course with a globally diversified, strategic portfolio, like the ones we manage.

Is -12.36% enough?: Since 1980, the AVERAGE intra-year S&P 500 decline has been 14%, as reported by J.P. Morgan (image above). The low point in 2022 for the S&P 500 is -12.36, this happened on March 8, 2022. Since March 8th, the S&P is up about 8%. I wonder and hope, if that -12.36% was enough for the year.

Growth vs Value: Since the start of the year, we’ve been significant price movement in all industries, but more so in “Growth” style companies when compared to “Value” style companies.

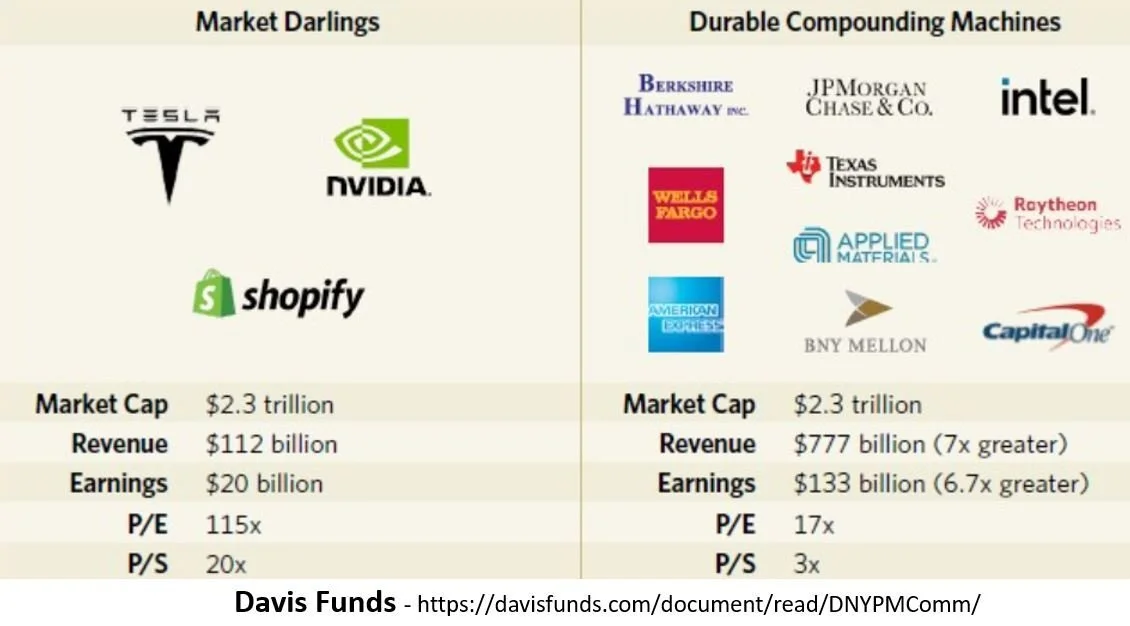

I’m hard pressed to find a better example of this than from a recent article published by Davis Funds (image above). In this article, Davis Funds compares “Market Darlings” companies which is composed of Tesla, Nvidia, and Shopify and “Durable Compounding” companies which is composed of Berkshire Hathaway, JP Morgan, Intel, Wells Fargo, Raytheon, amongst others.

The comparison goes on to show the “Market Darling” Companies have a Market Cap of $2.3 trillion dollars and the “Durable Compounding” companies have a Market Cap of $2.3 trillion. What’s more, the Darling companies have earnings of $20 billion compared to the Durable companies having earnings of $133 billion.

Now keep in mind the Darling companies certainly do have bright future prospects, which is exactly why their Market Cap is so high. However, let’s do the math on this, for these Darling companies to increase their earnings from $20 billion to $133 billion, their profits would need to grow by almost 21% each year for a decade!

Let me be crystal clear in what I’m saying and recommending. I’m fully recommending that you selectively own and selectively weight Growth AND Value companies. You own all of these type of companies in different weightings to create a balanced portfolio that is not going to time the market, but give you a balanced allocation of selective companies and give you time in the market. And if you’re curious, this is exactly how we manage portfolios. One of my favorite sayings is that if you own enough of a company or sector to make a killing in it, you also own enough to get killed by it too.

Additional Data: Each month I get asked by clients what additional resources I’d encourage reading. This month I have five.

Inflation - Federal Reserve | LPL Research on Inflation

Market Charts - JP Morgan

Jobs Report - AEI.org

Stagflation - First Trust Portfolios

In closing: We of course cannot control what the market does from here and we cannot predict when the next market downturn will occur. But we can control our behavior to these outside events and continue to stick with our long-term investment strategy.

As always, thank you for your trust, if you have any questions/concerns please contact me.

-Dave

Cedar Wealth’s Facebook | Cedar’s YouTube Channel

David Hobbs, CFP®, CLTC | Wealth Advisor | Founding Partner

Offices in Indianapolis & Terre Haute

Office: 317-559-2940

Schedule a MEETING

Email: D.Hobbs@CedarWealthPartners.com

www.CedarWealthPartners.com

Standard & Poor’s 500 (S&P 500) - a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy.

Russell 2000 – The index measures the performance of the small-cap segment of the US equity universe. It is a subset of the Russell 3000 and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

MSCI ACWI ex USA – The index measures the performance of the large and mid-cap segments of the particular regions, excluding USA equity securities, including developed and emerging market. It is free float-adjusted market-capitalization weighted.

Federal Funds Rate - refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

This report was prepared by Cedar Wealth Partners a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Neither the information nor any opinion expressed it so be construed as solicitation to buy or sell a security of personalized investment, tax, or legal advice. For more information please visit: https://adviserinfo.sec.gov/ and search for our firm name.

This newsletter is prepared to provide a degree of insight into the analysis used by Cedar Wealth to make investment decisions. It is not a complete description of all factors used by Cedar Wealth to make decisions on behalf of clients. The opinions included are not intended to be taken as fact, but are Cedar Wealth’s interpretation of the impact of external events on investments.

The information herein was obtained from various sources. Cedar Wealth does not guarantee the accuracy or completeness of information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. Cedar assumes no obligation to update this information, or to advise on further developments relating to it.

This article contains external links directing you to a third-party website. Although we have reviewed the website prior to creating the link, we are not responsible for the content of the sites.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation. The specific securities identified and described herein do not represent all of the securities purchased or sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. For a complete list of holdings please contact your portfolio advisor.