04/2023 - Silicon Valley Bank and Its Impact

Full written article below.

Over the past couple weeks, I’ve received more calls/messages from clients concerned about the market than I have other the past 15 months. Because of this, I’m guessing there are many more people who are also wondering what’s going on?

In this month’s newsletter, yes, coming out early, I’ll unpack some of the recent events, put them in perspective, and provide some hunches as to what we’ll see in the near future. And no, I don’t see this environment being the same as the 2007-2009 Financial Recession, the conditions appear to be entirely different.

We all know that Silicon Valley Bank (SVB) failed earlier this month, what you may not realize is that their balance sheet was actually pretty “normal.” Yes, they did cater to a heavy tech crowd, yes they took on LP positions with some of these tech start-ups, yes the Fed was aware this bank was in trouble, and yes 97% of the deposits at SVB were actually not covered by FDIC (NY Times).

Even with all these kind-of odd data points, the fundamental issue here is what the Fed has done with interest rates and how that’s impacted one of the most common investments on a banks balance sheet, which is Government Debt.

To help set the stage, let me lay out three easy to read charts.

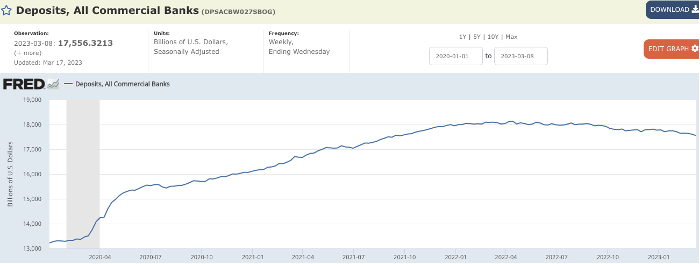

#1 New Deposits – When Covid hit, the government sent direct payments to Americans and most of these direct payments went directly into bank accounts. Source: Fed

#2 Interest Rates – When these new deposits hit bank accounts, the banks did what banks do, especially when there’s very little lending activity to be had, they put it to work, and one of the most common places banks put these dollars is with Government Debt. As you can see, when these new deposits hit, the Fed funds rate was basically zero but has since turned up sharply. Source: Fed

#3 When the Federal Reserve increases interest rates, it historically has a negative impact on bond positions. Because of this, the bonds that SVB, or any bank really, bought during Covid are very likely to be valued at less than what they bought them for. The below chart shows the Barclay’s US Treasury Index for 1-3, 5-7, 10-20, and 20 year+ bond durations. You’ll see the longer the duration (years) the more impact there has been. Source: Kwanti

Unfortunately, it isn’t just SVB that’s been impacted, my guess is the vast majority, if not all banks have been impacted, because of this, the Federal Reserve created a new program called Bank Term Funding Program (BTFP) Fed Press Release BTFP. As I read it, the BTFP allows banks and other eligible institutions to borrow the difference between what they originally bought at the Fed and what the value is today. This loan is only good for one year. Which then begs the question, how will these banks pay back the loan in a year’s time?

Just as bond values go down when interest rates rise, bond values historically go up when interest rates fall, so my guess is that the Fed is already planning on reducing the interest rate. More guessing here, I think they’ll at least reduce interest rates enough for the bond values to recover to at least cover the loan taken.

This provides banks and other institutions the liquidity they need to pass the Fed’s oversight supervision and doesn’t really cost the Fed much other than credibility.

Bringing this all back SVB and asking the question – so why did SVB fail? It sure appears that there was an asset/liability mismatch in that as soon as some of the depositors heard of trouble at SVB and then these same people or institutions realized they were over 250k FDIC limit, they took their money out and told their friends, which then forced SVB to sell government bonds to meet the cash withdrawals, which as noted above were very likely trading at less than what they were bought. This had a compounding impact until the Fed had to step in and call it a failed bank.

Ok – so I’ve gone on and on about this, but what does this mean to you? I don’t normally like to guess on any issue, none of us know the future, but here’s my hunch as to what this means.

1. Increased Fed regulation of banks – I’m not a big fan of regulation, but it does blow my mind that it doesn’t seem as though the Fed has the tools at their deposal to monitor the banks under their regulation. Based on the NYT article cited above, the Fed was aware of SVBs trouble.

2. Reduced Interest Rates – with the BTFP program, lower rates seem incredibly likely. Don’t forget that reducing interest rates has two immediate impacts. It makes holding money less appealing and makes borrowing money more appealing.

3. Fed’s Balance Sheet – Unfortunately with the expansion of the BTFP the Fed’s Balance sheet increased by 300 billion. My guess is it’ll increase in size as more banks take advantage of the BTFP program.

4. FDIC limits – It seems the 250k FDIC limits will be reviewed and likely increased.

Additional Data: Each month I get asked by clients what additional resources I’m looking at. Please hear me in stating I’m not trying to predict anything whatsoever, just some of the interesting data I’m watching. This month’s list of additional data points is really just an update from some of the prior months. I’m looking for continued trends, which at least currently, are continuing.

- Did We Just Hit Bottom? – Was my blog post from Nov 2022, where I make the argument that we may have hit bottom, who knows if I’m right or wrong, it’ll take another 12-24 months to know for sure. Regardless, since the date cited, the markets are up close to 11% (dates from 10/13/22 to 03/23/23 source: Yahoo Finance)

2. BLS.gov – (above chart) showing PPI 12 month percent change, notice the sharp decline, peak was in March 2022.

3. M2 Growth vs Inflation – This is something I’ve been commenting on for close to a year and a half. Yes, I’ve been in the camp that inflation is tied to M2. We won’t know if I’m right or wrong for another year or so, but I sure like what I keep seeing. Longtermtreands.net – The trend is continuing, lower M2 (black line) is now quite a bit lower and negative along with lower inflation (red line). The next M2 update occurs on 4/25/2023.

4. Breakeven Inflation Rate - Federal Reserve – 5-Year Breakeven inflation rate is now 2.31%. When you expand the chart to the “Max” history, you’ll notice we’re just about on par with the long-term average.

5. Federal Reserve Balance sheet – For months the Fed was following through on it’s statement made in May 2022 of reducing the balance sheet by 47.5 billion per month in months June-Aug 2022, then reducing the balance sheet by 95 billion per month. But, just in the past couple weeks, you’ll see the balance sheet spike up by 300 billion with the new BTFP. My guess is we’ll see the balance sheet trend higher as the BTFP funds flow through the financial system.

Market Truths

1. The Stock Market cannot be consistently known or timed

2. The Economy (as you define it) cannot be consistently known or timed

3. Over the past 100 years, the market has returned 10.45% (with dividends reinvested). It’d be difficult for someone to achieve this return if they did not simply stay invested. Data Source

4. The average intra-year market decline is about 14% and the market drops 15% or more every 3 years. J.P. Morgan | American Funds

5. Investing in equities has historically been volatile, my guess is it always will be, however when you consider equities (using the S&P 500 as a proxy), Real Estate, short-term bonds and corporate bonds, over the long-term, equities continue to be the historical winner. To crystallize this point, just look for yourself NYU.edu.

Market Beliefs

1. Because the future cannot be known, we must embrace the belief that the world isn’t going to end during our lifetimes, and if it does, our money doesn’t matter

2. The world has continued to advance, since well before Jesus walked the earth, so assuming the world doesn’t end, it’s rational to believe the world will continue to advance

In closing: We of course cannot control what the market does from here and we cannot predict when the next market downturn will occur. But we can control our behavior to these outside events and continue to stick with our long-term investment strategy.

As always, thank you for your trust, if you have any questions/concerns please contact me.

David Hobbs, CFP®

Wealth Advisor | Owner

Hobbs Wealth Management

Standard & Poor’s 500 (S&P 500) - a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy.

Russell 2000 – The index measures the performance of the small-cap segment of the US equity universe. It is a subset of the Russell 3000 and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

MSCI ACWI ex USA – The index measures the performance of the large and mid-cap segments of the particular regions, excluding USA equity securities, including developed and emerging market. It is free float-adjusted market-capitalization weighted.

Federal Funds Rate - refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

This report was prepared by Hobbs Wealth Management a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Neither the information nor any opinion expressed it so be construed as solicitation to buy or sell a security of personalized investment, tax, or legal advice. For more information please visit: https://adviserinfo.sec.gov/ and search for our firm name.

This newsletter is prepared to provide a degree of insight into the analysis used by Hobbs Wealth Management to make investment decisions. It is not a complete description of all factors used by Hobbs Wealth Management to make decisions on behalf of clients. The opinions included are not intended to be taken as fact, but are Hobbs Wealth Management’s interpretation of the impact of external events on investments.

The information herein was obtained from various sources. Hobbs Wealth Management does not guarantee the accuracy or completeness of information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. Hobbs Wealth Management assumes no obligation to update this information, or to advise on further developments relating to it.

This article contains external links directing you to a third-party website. Although we have reviewed the website prior to creating the link, we are not responsible for the content of the sites.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation. The specific securities identified and described herein do not represent all of the securities purchased or sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. For a complete list of holdings please contact your portfolio advisor.