10/2023 - What’s Next?

Full written article below.

From July 31 to Sept 29th the S&P 500 is down over 6%, this recent downturn has sparked numerous questions from clients about why the market is moving lower. The primary cause of the downturn is broadly summed up with the “Not Knowing” what the future will hold.

You see, the overall investing market loves known outcomes, I’m pretty confident we all enjoy known outcomes as well! Today’s economic environment is filled with unknowns. Economic, Political, Geo-Political, Social issues, etc… continue to fill the news media headlines.

Yes, we all want to know exactly what’s going to happen, but none of us know the future.

Current market downturns shouldn’t be unexpected, in fact, according to Capital Group, a 5% decline in the stock market typically happens three times a year and a 10% decline happens about once a year.

Reading today’s headlines will inform you that the Federal Reserve recently met and kept interest rates unchanged and now the expectation is that the Fed will keep interest rates higher for longer. You’ll read about an ever-increasing partisan political environment and higher levels of government debt. You’ll read about political messes on both sides of the aisle.

There certainly are negative headlines, that is reality. But in this month’s newsletter, I want to remind all of us, including myself, of the tumultuous US history in just the last 50 years. Because when I sit back and review what’s transpired in just the last 50 years, I simply don’t see how this time is all that different than so many times before. Historical Data Source

50 years ago – October 1973 – This was a busy month, Yom Kippur War in Israel, Watergate in the US with the resignation of the Vice President, the OPEC embargo of oil to the United States which quadrupled the price of oil, Nixon ordered the removal of the Watergate Special Prosecutor. The S&P 500 fell in price over a 16 month period by 48%

36 years ago – October 1987 – This month had the largest one-day stock market decline, it’s know as Black Monday for a reason as the broad market declined by 22% in a single day.

23 years ago – 2000-2002 – The broad market declined by close to 49% as the dot-com bubble burst, Enron collapsed and the World Trade Center terrorist attack unfolded.

15 years ago – 2008 – Financial Recession occurred which caused an over-haul in the financial industry with a broad market decline of 57% from peak to trough.

12 years ago – Greece debt crisis hit with the S&P 500 down about 20%

5 years ago – December 2018 – S&P 500 down about 20% in 13 weeks with concerns about the Federal Reserve over tightening.

3 years ago – Covid-19 Recession – S&P 500 down about 34% in just 33 days.

1 year ago – January-October 2022 – with 9% inflation and the steepest interest rate increases in history, the S&P 500 declined 25% over these 10 months

So what am I getting at?

My point with this history lesson is that today’s current unknowns, today’s current market decline, today’s current Fiscal, Political, Geo-Political landscape unknowns are simply what we’ve always seen.

This is why I’m so adamant about the message that when we invest dollars, we’re buying companies that have a history of making money, are historically well run, and are audited at least once a year. These companies are designed to return value to their shareholders (you and me). We are buying companies, we’re not buying countries or economies.

Additional Data: Each month I get asked by clients what additional resources I’m looking at. Please hear me in stating I’m not trying to predict anything whatsoever, just some of the interesting data I’m watching.

- Did We Just Hit Bottom? – Was my blog post from Nov 2022, where I make the argument that we may have hit bottom, we still need another year or so to know if I was right or wrong. Regardless, since the date cited, the markets are up close to 21% (dates from 10/13/22 to 09/06/23 source: Yahoo Finance)

- Is This a Great Country or What? – Four wonderful charts (2 of 4 below) showing the economic health of the US economy

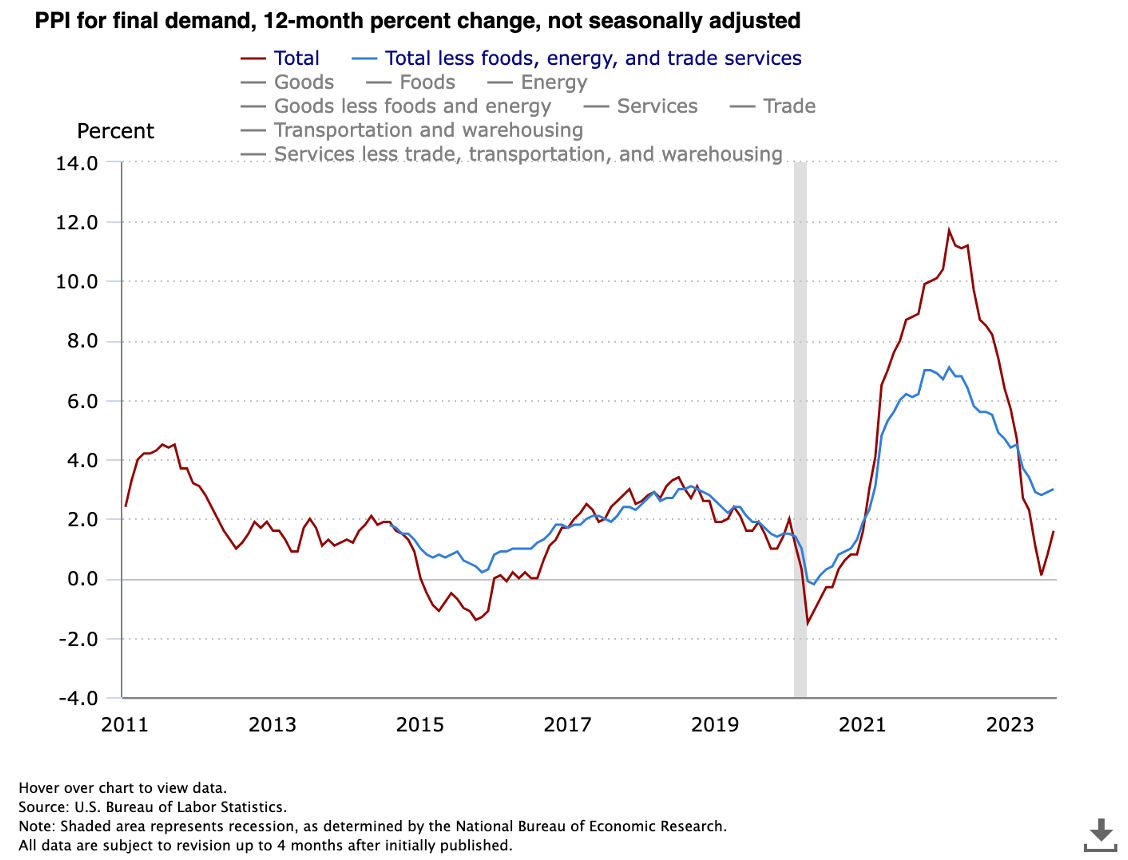

- BLS.gov - continued PPI reduction, peak was in March 2022.

- M2 Growth vs Inflation – This is something I’ve been commenting on for close to a year and a half. Yes, I’ve been in the camp that inflation is tied to M2. We won’t know if I’m right or wrong for another year or so, but I sure like what I keep seeing. Longtermtreands.net – The trend is continuing, lower M2 (black line) is now quite a bit lower and negative along with lower inflation (red line). M2 has fallen about 4% in the past 12 months.

- Breakeven Inflation Rate - Federal Reserve – 5-Year Breakeven inflation rate is now 2.22%. When you study this chart, you’ll see it goes back to 2004.

- Federal Reserve Balance sheet – For months the Fed was following through on it’s statement made in May 2022 of reducing the balance sheet by 47.5 billion per month in months June-Aug 2022, then reducing the balance sheet by 95 billion per month. But, just recently, you’ll see the balance sheet spike up by 300 billion with the new bank lending program but then a quick reversal.

Market Truths

1. The Stock Market cannot be consistently known or timed

2. The Economy (as you define it) cannot be consistently known or timed

3. Over the past 100 years, the market has returned 10.45% (with dividends reinvested). It’d be difficult for someone to achieve this return if they did not simply stay invested. Data Source

4. The average intra-year market decline is about 14% and the market drops 15% or more every 3 years. J.P. Morgan | American Funds

5. Investing in equities has historically been volatile, my guess is it always will be, however when you consider equities (using the S&P 500 as a proxy), Real Estate, short-term bonds and corporate bonds, over the long-term, equities continue to be the historical winner. To crystallize this point, just look for yourself NYU.edu.

Market Beliefs

1. Because the future cannot be known, we must embrace the belief that the world isn’t going to end during our lifetimes, and if it does, our money doesn’t matter

2. The world has continued to advance, since well before Jesus walked the earth, so assuming the world doesn’t end, it’s rational to believe the world will continue to advance

In closing: We of course cannot control what the market does from here and we cannot predict when the next market downturn will occur. But we can control our behavior to these outside events and continue to stick with our long-term investment strategy.

As always, thank you for your trust, if you have any questions/concerns please contact me.

David Hobbs, CFP®

Wealth Advisor | Owner

Hobbs Wealth Management

Standard & Poor’s 500 (S&P 500) - a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy.

Russell 2000 – The index measures the performance of the small-cap segment of the US equity universe. It is a subset of the Russell 3000 and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

MSCI ACWI ex USA – The index measures the performance of the large and mid-cap segments of the particular regions, excluding USA equity securities, including developed and emerging market. It is free float-adjusted market-capitalization weighted.

Federal Funds Rate - refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

This report was prepared by Hobbs Wealth Management a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Neither the information nor any opinion expressed it so be construed as solicitation to buy or sell a security of personalized investment, tax, or legal advice. For more information please visit: https://adviserinfo.sec.gov/ and search for our firm name.

This newsletter is prepared to provide a degree of insight into the analysis used by Hobbs Wealth Management to make investment decisions. It is not a complete description of all factors used by Hobbs Wealth Management to make decisions on behalf of clients. The opinions included are not intended to be taken as fact, but are Hobbs Wealth Management’s interpretation of the impact of external events on investments.

The information herein was obtained from various sources. Hobbs Wealth Management does not guarantee the accuracy or completeness of information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. Hobbs Wealth Management assumes no obligation to update this information, or to advise on further developments relating to it.

This article contains external links directing you to a third-party website. Although we have reviewed the website prior to creating the link, we are not responsible for the content of the sites.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation. The specific securities identified and described herein do not represent all of the securities purchased or sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. For a complete list of holdings please contact your portfolio advisor.