09/2023 - US Debt Downgrade

Full written article below.

As we come upon the September 11th anniversary, I’m reminded of a statement from Isaiah Berlin “Those who value liberty for its own sake believe that to be free to choose, and not to be chosen for, is an inalienable ingredient in what makes human beings human.”

In case you missed it, last month, the ratings agency, Fitch Ratings, downgraded the sovereign debt of the United States. Some market commentators were surprised by this downgrade, I can’t really see why they’d be surprised when another rating agency, S&P, downgraded US debt over 10 years ago.

Part of this current downgrade is because of the Congressional Budget Office’s report on June 28, here, where they cite increased federal spending assumptions that’ll push fiscal deficits to more than 6% of GDP. Let history be a guide here and know that from years 1950-2008 the US never had a deficit over 6.5%, source. Also, let me be clear that is a bi-partisan problem that needs a bi-partisan solution. Both political parties have over-spent and have not addressed entitlements, which have certainly helped to pave the way to this current deficit.

Keep in mind that we are not in a recession and we are not in a World War and the unemployment rate is under 4%. So trying to articulate why the deficit is projected to be so high is beyond my comprehension. What’s more, finding the political will for career politicians to do anything about it is highly unlikely. I wouldn’t be surprised if things had to get worse before they can get better.

This is a developing situation, no one will be able to correctly predict what the solution will be or when the solution will come. However, the long-term view with investing remains unchanged. We’re not blinding investing in the macro-economy at large; we’re investing in companies with profitable track records that are seeking to grow their businesses and continuously innovate.

Don’t forget, the S&P 500 has lost about 50% of its value on three different occasions in just the last 50 years, but you know what? The world keeps spinning and these profitable companies keep finding ways to make more money. So yes, my continued encouragement hasn’t changed, and I doubt it’ll ever change. That unless the world ends, we stay invested.

And no, this belief to stay invested isn’t just a blind hope, if you’re looking for perspective from a Ph.D. in Economics, take 5 minutes and read this article from David Henderson about the “Wonders of Economic Growth.”

Additional Data: Each month I get asked by clients what additional resources I’m looking at. Please hear me in stating I’m not trying to predict anything whatsoever, just some of the interesting data I’m watching.

- Did We Just Hit Bottom? – Was my blog post from Nov 2022, where I make the argument that we may have hit bottom, we still need another year or so to know if I was right or wrong. Regardless, since the date cited, the markets are up close to 26% (dates from 10/13/22 to 09/06/23 source: Yahoo Finance)

- The Cost of Timing the Market – Clear and compelling visual on why it’s so incredibly important to stay invested.

- BLS.gov - continued PPI reduction, peak was in March 2022.

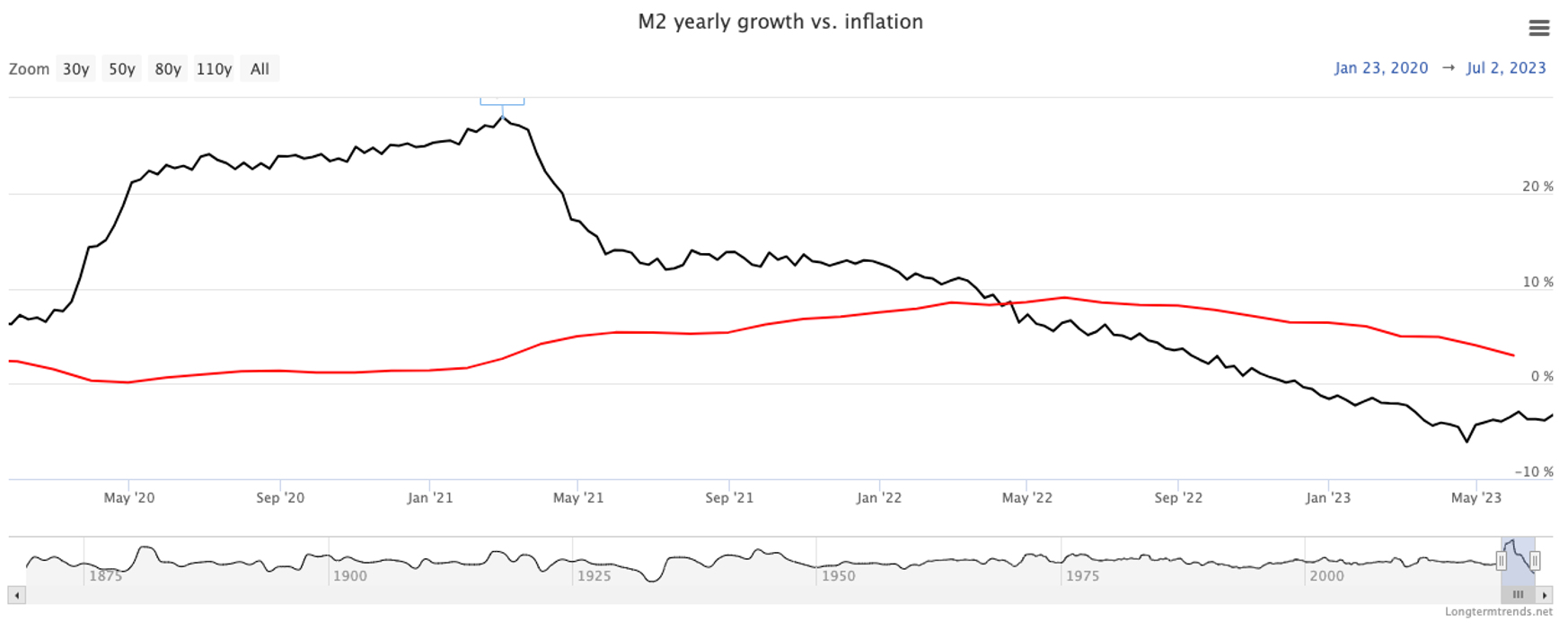

- M2 Growth vs Inflation – This is something I’ve been commenting on for close to a year and a half. Yes, I’ve been in the camp that inflation is tied to M2. We won’t know if I’m right or wrong for another year or so, but I sure like what I keep seeing. Longtermtreands.net – The trend is continuing, lower M2 (black line) is now quite a bit lower and negative along with lower inflation (red line). M2 has fallen about 4% in the past 12 months.

- Breakeven Inflation Rate - Federal Reserve – 5-Year Breakeven inflation rate is now 2.15%. When you study this chart, you’ll see it goes back to 2004.

- Federal Reserve Balance sheet – For months the Fed was following through on it’s statement made in May 2022 of reducing the balance sheet by 47.5 billion per month in months June-Aug 2022, then reducing the balance sheet by 95 billion per month. But, just recently, you’ll see the balance sheet spike up by 300 billion with the new bank lending program but then a quick reversal.

Market Truths

1. The Stock Market cannot be consistently known or timed

2. The Economy (as you define it) cannot be consistently known or timed

3. Over the past 100 years, the market has returned 10.45% (with dividends reinvested). It’d be difficult for someone to achieve this return if they did not simply stay invested. Data Source

4. The average intra-year market decline is about 14% and the market drops 15% or more every 3 years. J.P. Morgan | American Funds

5. Investing in equities has historically been volatile, my guess is it always will be, however when you consider equities (using the S&P 500 as a proxy), Real Estate, short-term bonds and corporate bonds, over the long-term, equities continue to be the historical winner. To crystallize this point, just look for yourself NYU.edu.

Market Beliefs

1. Because the future cannot be known, we must embrace the belief that the world isn’t going to end during our lifetimes, and if it does, our money doesn’t matter

2. The world has continued to advance, since well before Jesus walked the earth, so assuming the world doesn’t end, it’s rational to believe the world will continue to advance

In closing: We of course cannot control what the market does from here and we cannot predict when the next market downturn will occur. But we can control our behavior to these outside events and continue to stick with our long-term investment strategy.

As always, thank you for your trust, if you have any questions/concerns please contact me.

David Hobbs, CFP®

Wealth Advisor | Owner

Hobbs Wealth Management

Standard & Poor’s 500 (S&P 500) - a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy.

Russell 2000 – The index measures the performance of the small-cap segment of the US equity universe. It is a subset of the Russell 3000 and includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

MSCI ACWI ex USA – The index measures the performance of the large and mid-cap segments of the particular regions, excluding USA equity securities, including developed and emerging market. It is free float-adjusted market-capitalization weighted.

Federal Funds Rate - refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

This report was prepared by Hobbs Wealth Management a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Neither the information nor any opinion expressed it so be construed as solicitation to buy or sell a security of personalized investment, tax, or legal advice. For more information please visit: https://adviserinfo.sec.gov/ and search for our firm name.

This newsletter is prepared to provide a degree of insight into the analysis used by Hobbs Wealth Management to make investment decisions. It is not a complete description of all factors used by Hobbs Wealth Management to make decisions on behalf of clients. The opinions included are not intended to be taken as fact, but are Hobbs Wealth Management’s interpretation of the impact of external events on investments.

The information herein was obtained from various sources. Hobbs Wealth Management does not guarantee the accuracy or completeness of information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. Hobbs Wealth Management assumes no obligation to update this information, or to advise on further developments relating to it.

This article contains external links directing you to a third-party website. Although we have reviewed the website prior to creating the link, we are not responsible for the content of the sites.

An index is an unmanaged portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation. The specific securities identified and described herein do not represent all of the securities purchased or sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. For a complete list of holdings please contact your portfolio advisor.